What is a 1098-T Form?

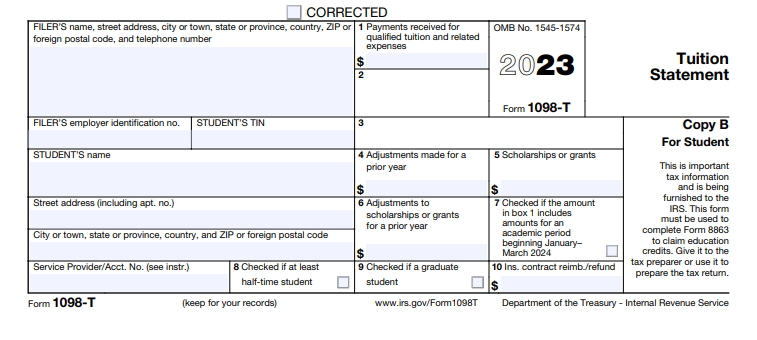

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Educational institutions file this form for each individual that has made payments for qualified tuition related expenses.

Section 6109 of the Internal Revenue Code requires you to give your correct SSN to MCC since we must file an information return (1098-T) with the IRS. The IRS uses the social security number for identification purposes and to help verify the accuracy of your tax return. If you fail to furnish your correct SSN to MCC, you are subject to a penalty of $50.00 from the IRS.

Instructions

Call the MCC Contact Center at 531-622-5231 to verbally give your SSN.

More Information about the form:

If a 1098-T form is NOT available on Self Service, there may be several reasons that a 1098-T was not generated for a student:

- The student did not have tuition charges in the calendar year.

- The student did not have an address in Colleague at the time the 1098-Ts were generated. The student would need to update the address, and then contact Leslie McFadden at 531-622-2715 to generate a 1098-T.

- The student's information in Box 1 (qualified tuition payments received) and Box 5 (financial aid, agency billing, tuition remission, etc.) were equal and netted to a zero amount.

- The student is an international student and did not provide MCC with a social security number. If you are an international student and do have a social security number, contact Leslie McFadden at 531-622-2715 to generate a 1098-T.

To view/print a copy of the IRS 1098-T form, open your browser and go to https://www2.mccneb.edu/student-extranet. Enter your MCC login ID and password. Select Self-Service and then on Tax Information to view the actual IRS form. Your browser’s print function can then be used to print the form.

GENERAL INFORMATION ABOUT THE 1098-T FORM

The Form 1098-T may be used to verify that you are eligible to claim one of the tax credits described below. MCC is required to send a copy of this form to the Internal Revenue Service in order to notify them of your potential eligibility to claim the credit.

Box 1 has been filled for Qualified Tuition Payments Received. Prior to the 2018 calendar year, the MCC 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QRTE) MCC billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, MCC will report in Box 1 the amount of QTRE you paid during the year.

The American Opportunity Credit is a refundable tax credit for undergraduate college expenses. It is a tax credit of up to $2,500 of the cost of tuition, fees, and course materials paid during the taxable year as long as the student attended college at least half-time (Box 8). Taxpayers will receive a tax credit based on 100 percent of the first $2,000, plus 25 percent of the next $2,000, paid during the taxable year for tuition, fees, and course materials. Required course materials, books and school supplies are an eligible expense for this credit only. See IRS Pub 970 and/or your tax advisor for other criteria.

The Lifetime Learning Credit applies to tuition and fees for all postsecondary education and for courses to acquire or improve job skills. A family can claim on its tax return a credit equal to 20% of the first $10,000 of adjusted qualified education expenses. The maximum Lifetime Learning Credit you can claim on your return for the year is $2,000. There is no limit on the number of years the Lifetime Learning Credit can be claimed for each student.

It is the student's responsibility, with the help of their tax advisor, to determine the amount that should be reported on Form 8863. Metropolitan Community College does not provide tax advice to any taxpayer or student. Additional information can be obtained by calling the IRS at 1-800-829-1040, or by accessing their web site at www.irs.gov. Publication 970, "Tax Benefits for Higher Education," explains the provisions of each credit in detail.

To view/print a copy of the IRS 1098-T form, open your browser and go to https://www2.mccneb.edu/student-extranet . Enter your MCC login ID and password. Click on Student SelfService and then on Tax Information (1098-T) to view the actual IRS form. Your browser’s print function can then be used to print the form.

If you have further questions about the 1098-T form, you may stop at the Student Services counter at any campus or speak directly with the Student Accounts Office at 531-622-2405 option 3.

MCC’s Account Receivable Specialist are not tax consultants and are not able to answer any tax questions. MCC recommends contacting the IRS or your tax preparer for questions on your 1098-T form or filing requirements.